Income Tax Act

Bill to Amend--Third Reading

June 17, 2021

Moved third reading of Bill S-222, An Act to amend the Income Tax Act (use of resources).

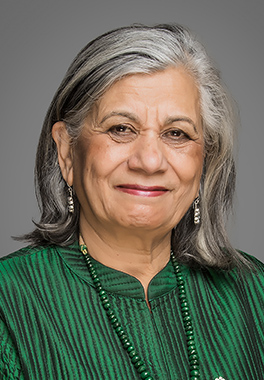

She said: Honourable senators, I am delighted to speak at third reading to Bill S-222, the effective and accountable charities act.

In keeping with the interest of so many of my colleagues who wish to speak to their items on the Order Paper after me, I will choose brevity over eloquence to make three brief points.

First, I wish to express my sincere appreciation to the Senate National Finance Committee: to its chair, Senator Mockler, and to steering committee members Senator Klyne and Senator Forest for their facilitation and timely review of this bill. I wish to offer my appreciation as well to Senators Coyle and Mercer for their support of the bill at second reading, with special mention to the leadership of Senator Mercer for his calling into life the Senate charity study on which this bill rests, and to the critic of the bill, Senator Plett, for his support of the bill. A friendly critic is a gift indeed.

Second, very briefly, let me outline the need for this amendment. It will remove a significant hindrance and reams of red tape that result in inefficiencies, legal expenses and power imbalances for charities, both domestically and internationally. It will finally give space to Indigenous and racial justice groups in Canada to play a meaningful role in the charitable sector, which is dealing with a hidden expression of systemic racism in the law. This amendment will also remove the vestiges of colonialism from our international development charities, and it will do all this without sacrificing any measure of accountability for charitably exempt dollars.

Because the amendment lays out the process for assuring resource accountability, there will be upfront due diligence, agreements on activities and timelines, as well as budgets and reporting between the research charity and the non-charity. The non-charity will provide full accountability to the charity for receiving and reporting on the use of funds, as per the timelines agreed upon, and about the progress on outcomes and impact. However, the non-charity will not be controlled or dictated to by the charity, as is the current practice emanating from the law. The project management will rest with the non-charity.

As such, Bill S-222 accomplishes two important objectives: First, it provides accountability; and second, it provides for empowering partnerships. It is not an “either-or.” Accountability and empowerment, and accountability and partnerships, are not mutually exclusive concepts.

Finally, colleagues, I humbly look to you for your support in sending this bill to the House of Commons. Thank you.

Honourable senators, I will be equally brief. It is indeed my pleasure to rise to speak to Bill S-222 at third reading. As I said in my second reading speech, although I stand in the role of critic of this bill, I am very supportive of the legislation and am pleased to see it moving along expeditiously.

I hope Senator C. Deacon will take note. He reminded me the other day that he hoped I would be equally enthusiastic about moving forward legislation that was not necessarily brought forward by the Conservatives. I want to assure him that I am doing that today.

I wish to thank Senator Omidvar for her work on this bill, as well as the members of the Standing Senate Committee on National Finance. I would like to note the good work undertaken by the Special Senate Committee on the Charitable Sector. Their study in the last Parliament helped to increase awareness of the challenges faced by the charitable sector and underscored that many changes are needed. This bill addresses one of those changes.

Colleagues, in a parliamentary system that depends on parliamentary opposition to function properly, it is always gratifying to find issues upon which there is broad consensus and cooperation. When that happens in this chamber, as it has with this bill, it leaves one hopeful that the same will be true in the other chamber.

However, as we know, that is not always the case. If the Senate chooses to pass Bill S-222 and send it to the other place, it will be arriving at the eleventh hour before the summer recess. Although the Leader of the Opposition, Erin O’Toole, has expressed his support for making changes to the direction and control regime, it is unknown whether the government is ready to move this bill forward.

I would note that at committee, officials from the Canada Revenue Agency did not express any concern about the proposed changes, apart from the fact that it will take 12 to 18 months to put the changes in place. However, the bill provides a two-year window before coming into force, which will give them ample time to have the necessary consultations and develop new guidance for charities.

Nevertheless, uncertainty over the government’s support, the short timeline before rising for the summer and the possibility of a fall election or prorogation all leave the bill’s future hanging in the balance. In light of this, I encourage senators to support this bill and send it to the other place as quickly as possible for their consideration.

As Bruce MacDonald, President and CEO of Imagine Canada, noted at committee, the legislation will create “a more effective and efficient system.” It will reduce the amount of red tape that charities have to deal with, the number of contracts or agreements that are needed, and the legal costs that organizations are compelled to incur. It will bring Canada into line with other regimes like Australia, the U.S. and the U.K.

Colleagues, as I have noted, the changes proposed by this bill are necessary and long overdue. It is my hope that you will continue to support this bill and vote for it now.

Is it your pleasure, honourable senators, to adopt the motion?

Hon. Senators: Agreed.

(Motion agreed to and bill read third time and passed.)